Structured funding and clear exit for a complex HMO project

Author: John Bremner

Date: 10/10/2025

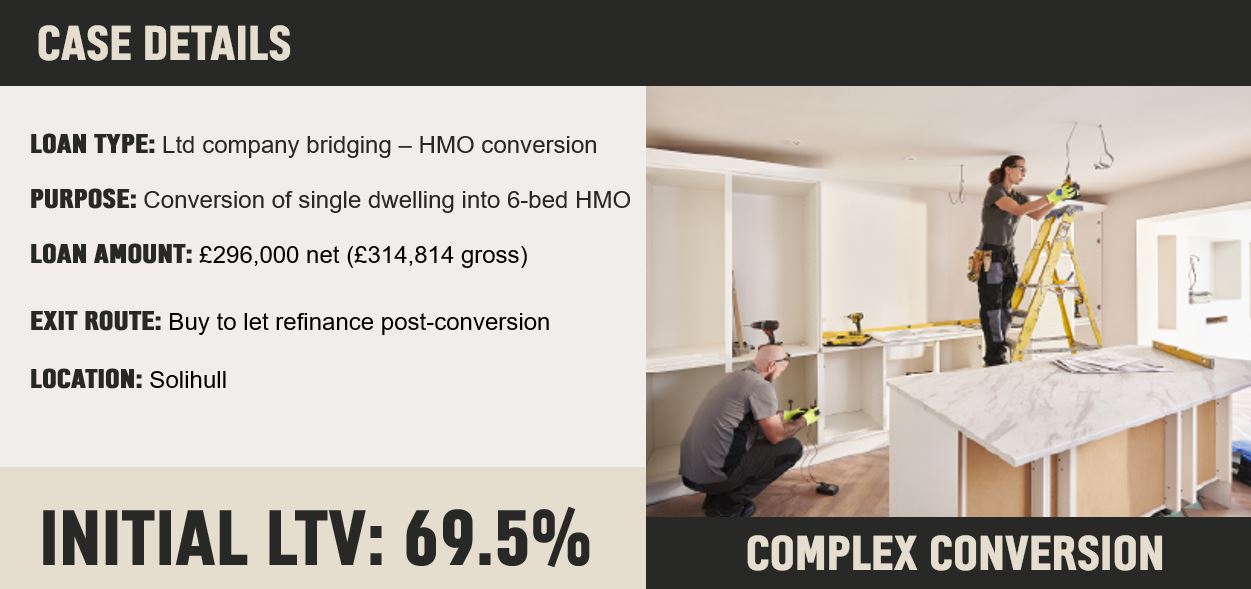

Scenario

A limited company purchased a property in Solihull with the aim of converting it into a 6-bed HMO. The works required a full strip out, reconfiguration, plumbing, electrics and decoration to bring the property up to standard for multiple occupancy.

Outcome

We provided a £296,000 net loan (£314,814 gross) at 0.75% with an initial 69.5% LTV. The exit strategy was set via a buy to let refinance once the conversion works were complete, giving the customer a clear pathway to long-term income generation from the property.

Why it worked

- Tailored solution – funding structured to support a full conversion project.

- Clear exit – transition into a buy to let refinance, securing long-term rental yield from the HMO.

- Flexibility – funding provided to a limited company for a specialist HMO project, where not all lenders would engage.

- Broker advantage – shows how working with Precise can open up complex opportunities for investors and landlords.

Got a case like this?

Speak to your specialist finance manager or call 0800 116 4385 today.