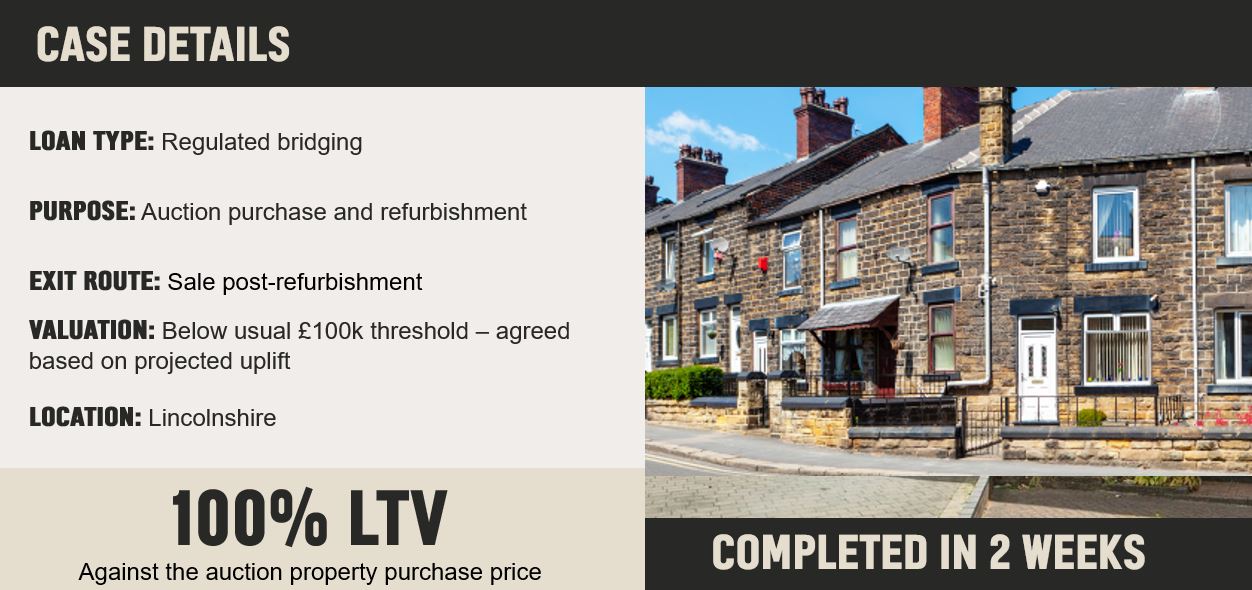

Speed and flexibility deliver 100% LTV for an auction buyer

Author: John Bremner

Date: 14/10/2025

Scenario

We recently supported a borrower on a property flip in Lincolnshire that really shows the value of flexibility.

We helped the customer to purchase a terraced house at auction for £70,500 secured by way of a first charge against the property. We also provided an additional £12,000 towards the completion of refurbishment works on that property. This was secured by way of a second charge against another property owned by the borrower.

In this case, the purchase property fell below our minimum property value threshold. However, we were able to take a forward-looking approach, recognising the uplift in value post-refurbishment, and agree the deal by incorporating additional property as security in order to release a higher net loan.

Outcome

Our Specialist Finance Account Manager, John Bremner, worked closely with Kerrie Wilkinson at Cloud Bridging to shape a solution that was right for her customer. Thanks to strong collaboration and clear communication from our in-house underwriters, we achieved instruction to completion in just 2 weeks – critical for an auction purchase.

While property flipping has become more challenging since the recent SDLT changes, opportunities are still out there, especially on purchases under the £125,000 threshold in high-demand areas.

This case shows how we can work in partnership with brokers to overcome challenges, move quickly and deliver the right outcome for customers.

Got a case like this?

Speak to your specialist finance manager or call 0800 116 4385 today.