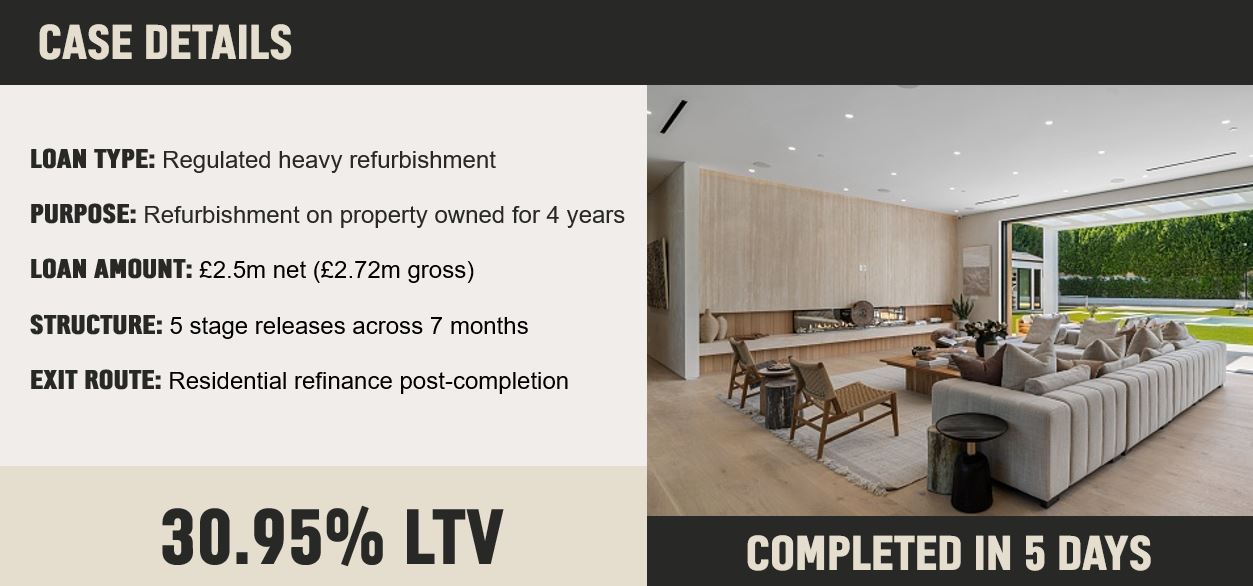

From offer to completion in just 5 days on a £2.5m refurb deal

Author: John Bremner

Date: 10/10/2025

Scenario

A customer needed funding to complete major refurbishment works on a property purchased 4 years earlier. The project required a 7-month timeframe with 5 stage releases to manage cash flow throughout the build.

Outcome

We provided a £2.5m net loan (£2.72m gross) at a competitive rate, with an overall LTV of 30.95%. Despite the complexity of the case, including the need for a long-form valuation and credit committee approval, we moved from offer to completion in just 5 days. Once works were finished, the customer exited via a residential refinance.

Why it worked

- Speed where it counts – completion achieved in just 5 days, even with additional requirements.

- Flexibility in funding – staged releases tailored to the 7-month works programme.

- Clear exit strategy – residential refinance already in place once refurb is complete.

- Broker confidence – Precise’s ability to handle large, complex refurb cases with a smooth process from underwriting to completion.

How we compare

Flexibility:

- Precise – comfortable lending on a large £2.5m net loan with a clear exit strategy.

- Typical market – many lenders may either restrict loan size, increase rates or hesitate on heavy refurb projects with extended timelines.

Exit certainty:

- Precise – structured with a planned residential refinance exit, reducing risk for both broker and borrower.

- Typical market – not all lenders will proceed confidently without a tightly defined exit, especially on complex refurb cases.

Got a case like this?

Speak to your specialist finance manager or call 0800 116 4385 today.