Creative funding with second charge security enables light refurb purchase

Author: Jodie Worswick

Date: 27/08/2025

Scenario

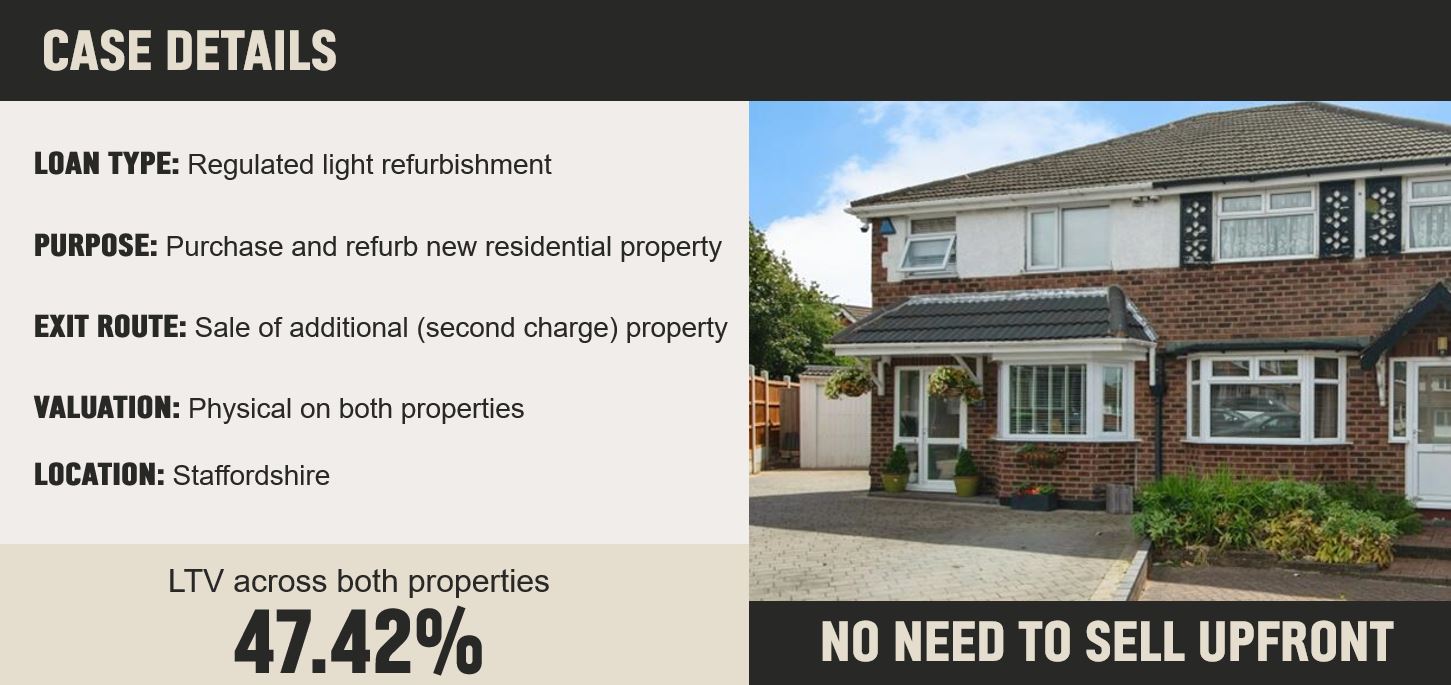

A borrower required a regulated light refurbishment bridging loan to purchase a new residential property. To make the deal viable and meet affordability and security requirements, the customer offered an additional property as second charge security.

The proposed exit strategy was a combination of the sale of the second charge property and a residential refinance of the newly purchased home once the refurbishment was completed.

Outcome

The borrower successfully completed the purchase and began refurbishment works on the new home. The sale of the second charge property completed within the loan term, contributing to a reduced refinance amount.The remaining balance was refinanced onto a residential mortgage, enabling the customer to remain in the new property with improved condition and long-term affordability secured.

This creative solution allowed the borrower to secure the new property and fund necessary refurbishments, while keeping monthly costs manageable. By using a second charge on an existing asset, the customer avoided delays or the need to sell upfront.

Why it worked

- Combined LTV within acceptable limits

- Clear dual exit strategy

- Suitable for physical valuation

- Flexible underwriting approach

- Clean application supported by broker

Helping your customers move quickly starts with the right lender.

Got a case like this?

Speak to your specialist finance manager or call 0800 116 4385 today.

Contact Us

Essential maintenance: Please note that due to scheduled essential maintenance, broker portal will be unavailable between the hours of 5.30pm and 7pm on Monday 2 February. We apologise for any inconvenience caused.