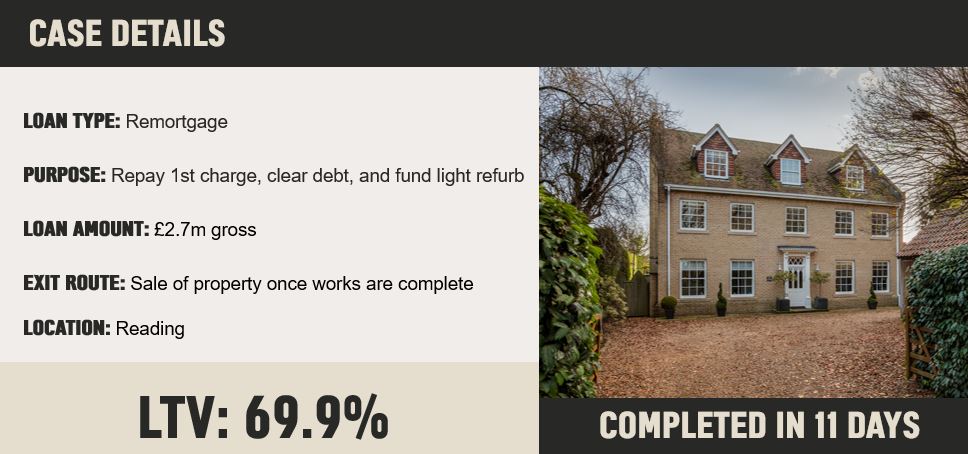

£2.7m loan. Quick turnaround. Sale exit.

Author: John Bremner

Date: 31/10/2025

Scenario

Our customer needed to remortgage in order to repay an existing 1st charge, clear some unsecured borrowing, and fund a light refurbishment to maximise the property’s value ahead of sale. Timing was critical, and the broker required a fast, reliable solution.

Outcome

Precise provided a £2,743,664 gross loan with an initial 69.9% LTV. The agreed exit strategy was the sale of the property once works were complete - keeping the project moving without delays or unnecessary compromises.

Why it worked

Speed where it mattered. Offer to completion was done in just 11 days, helping the customer meet their urgent financial needs.

High-value expertise. Ability to support large loans that many lenders may avoid.

Simple exit. Sale-based repayment accepted, giving flexibility to the broker and their customer.

Broker advantage. A real example of how bridging can unlock cash flow, reduce pressure, and keep investments on track.

Got a case like this?

Speak to your specialist finance manager or call 0800 116 4385 today.